New Research Available: The Global Market for Data Acquisition Technologies

The global market for data acquisition (DAQ) solutions—technologies used to convert physically or electrically measured signals such as temperature or pressure into digital output suitable for computer processing—will continue to expand as business leaders worldwide increasingly emphasize the importance of data-driven decision making.

Despite this continued market growth, the desire to simplify data acquisition processes has surged. Companies no longer have the time to execute different measurements across different systems using different interfaces, nor do they have the resources to dispatch field technicians to manually manage, execute, and retrieve measurement data from hundreds or even thousands of connected field instruments and other data sources spanning multiple physical locations.

With customers focused on ensuring that the execution and administration of their DAQ processes are both streamlined and efficient, the most successful DAQ suppliers will be those offering solutions with strengths that go beyond basic requirements such as speed or accuracy. Usability-focused features―such as measurement unification, remote measurement capabilities, and pre-configured applications―will be among the primary differentiators that will define the competitive landscape for the foreseeable future.

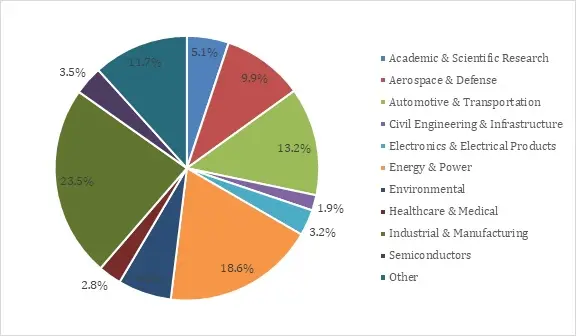

The industrial and manufacturing sector was the leading source of revenue for DAQ technologies in 2021 (as shown in the exhibit below). In addition to traditional DAQ objectives such as machine monitoring and end-of-line quality control, the continued worldwide emphasis on improving factory automation is among the key factors bolstering revenue generation in this vertical in recent years. With predictive maintenance and other data-centric IIoT initiatives accelerating demand for the DAQ technologies necessary to enable advanced analytics strategies, this sector will also attain above-average growth through the end of the forecast period in 2026. Given the unique macroeconomic trends present in different industrial sectors, however, growth within discrete industrial sub-segments will vary. Hottinger Brüel & Kjær, NI, and Yokogawa are among the industry leaders targeting this space.

Global Share of Data Acquisition Technologies Revenue by Vertical Market, 2021

More Insight

How will the COVID-19 pandemic affect market growth? Will cellular 5G or Wi-Fi 6 have a significant impact on the industrial space? Which suppliers command the greatest shares of the wireless and wireline markets? How will end-user preferences shape market growth? VDC’s recently published industrial networking studies explain.

This multi-volume program includes detailed analyses of both the supply side and the demand side of this market:

- The Global Market for Data Acquisition Technologies (available now); and

- Data Acquisition Solutions User Requirements Analysis (available Q2 2022)

Please contact us for more information.